Previous Pay

In this section, we need information about the employee's previous pay from a previous system or a previous employment if they are a New Starter. This data has a degree of complexity so contact

Also, this section enables the user to create or update tax-related documents for the respective employees. You can also batch upload the information via the Upload button.

Prerequisites

Rules and Guidelines

- Fields that are marked with red asterisks (*) are mandatory.

Field Information

These fields display the employee's name.

This field displays the employee's company.

Enter the employee's National Insurance number. The format of the NI number is 'AANNNNNNA' (where 'A' = an alpha character and 'N' = numeric).

|

Note: All NI number prefixes (first 2 characters) will be checked for validity against a list provided by HMRC. WARNING: The last character of the NI number is not the National Insurance Table letter. |

This dropdown allows you to input the details from a previous employment or the values from a previous system. Selecting the option from the dropdown list will load a screen which enables you to enter the data.

- Previous Payroll Data

If you have paid any employee in the current tax year, the following values should be entered:

- Tax Paid

Leavers for this tax year must be entered in this section.

- Tax Code - This holds employee's tax code.

- Tax Regime - In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

- Total Taxable Pay to date - This must be in numeric form with no decimal. This is mandatory.

- Total Tax Deducted date - This must be in numeric form with no decimal. '0.00' is automatically used if no tax paid. This is mandatory.

- Taxable Pay from Previous Employment - Only enter value in this field if the employee started this year.

- Tax Deducted from Previous Employment - Only enter value in this field if the employee started this year.

- Student Loan to Date - This must be in numeric form with no decimal values.

- NI Paid

NI Figures only relate to the current employment; no previous pay is used.

- Ni'able Earnings - This must be in numeric form with no decimal values.

- Earnings & LEL- Where LEL = Lower Earnings Limit, this must be in numeric form with no decimal values.

- Earnings > LEL up to PT - Where LEL = Lower Earnings Limit and PT = Primary Threshold, this must be in numeric form with no decimal values.

- Earnings > PT up to UAP - Where PT = Primary Threshold and UAP = Upper Accrual Point, this must be in numeric form with no decimal values.

- Earnings > UAP up to UEL - Where UAP = Upper Accrual Point and UEL = Upper Earnings Limit, this must be in numeric form with no decimal values.

- Earnings > UEL - Where UEL = Upper Earnings Limit, this must be in numeric form with no decimal values.

- Employee NI Contributions > PT - This must be in numeric form with no decimal values.

- Employer Contributions - This must be in numeric form with no decimal values.

- Leave Paid

- SSP Paid this tax Year - Where SSP = Statutory Sick Pay, this must be in numeric form with no decimal values.

- SMP Paid this tax Year - Where SMP = Statutory Maternity Pay, this must be in numeric form with no decimal values.

- OSPP Paid this tax Year - Where OSPP = Ordinary Statutory Paternity Pay, this must be in numeric form with no decimal values.

- SAP Paid this tax Year - Where SAP = Statutory Adoption Pay, this must be in numeric form with no decimal values.

- Tax Paid

- P45 incl. New Pension Starter Details

Certain details from the new employee's P45 from previous employer are needed. Most of these details are self-explanatory but to aid you we have clarified a few areas:

-

Employee PAYE Reference

Enter these as shown on the P45 you have received from your new starter.

-

Student Loan deductions to continue

If P45 is indicated as such in Position 5, then check this box.

-

Tax code at leaving date

Enter the tax code including any prefix such as 'K' shown on the P45. Where this is prefixed with an 'S', then this must go in the tax regime.

-

Tax Regime

In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

-

Week 1/Month 1

Where this is indicated as part of Position 6 on the P45, then please check this box. Week 1/Month 1 indicates that the cumulative pay & tax is not taken into consideration in the calculation of tax due each pay period.

-

Tax Period left

Where the Week 1/ Month 1 is not indicated, please enter either the Tax Week number or Tax Month number shown in Position 7 on the P45. For the Total Pay to date & Total Tax to date, please enter as shown in Position 7 on the P45.

-

Week/Month

If paid, indicate 'W' for Weekly or 'M' for Monthly.

-

NB

Where the leaving date on the P45 shows as being in the previous tax year (6th April to 5th April 2014/15), please note the following rules:

Date of Leaving Start Date Code on P45 Starter Declaration Tax Code to Use Previous Tax Year Start of current tax year to 24 May of that year Not BR, 0T, D0 or D1 B Code from P45 + for L codes, add budget uplift and ignore any month 1 indicator from P45 Previous Tax Year 25 May onwards Not BR, 0T, D0 or D1 B Current emergency code on a non-cumulative basis -

The current tax year goes from 6th of April 2015 to 5th of April 2016.

If the New starter is on a Pensioner payroll, then use the tax code on P45 but on a Week1/ Month1 basis.

Additional information that needs to be provided to HMRC on the FPS in such cases are:

1. Occupational Pension Indicator - Please check this box.

2. Annual Amount of Occupational Pension - Please enter annual pension.

3. Occupational Pension paid because recently bereaved - This is where a spouse is taking the pension where the employee died. Please check this box if appropriate. In this case, all the details entered should relate to the spouse not the deceased.

4. Enter hours worked as 'E' Other - This will automatically be set once 'Occupational Pension' indicator is entered.

-

- Starter Checklist No P45

-

Starter Statement

Select the corresponding statement from the Starter Check List A, B or C here, as indicated by the employee.

-

I have a Student Loan which is not fully repaid

If this is indicated on the Starter Check List, then please check this box.

- Current Tax Code

For Tax Year 2017-2018, once the appropriate employee statement has been entered, please use one of the following tax codes according to the statement entered:

- Statement A - Use 1150L

- Statement B - Use 1150L with a Week1/ Month 1 indicator

- Statement C - Use BR

If the employee has not indicated any of the above, then the employer must enter "Employee Statement" as 'C' and operate tax at code 'T' on a Week1/ Month 1.

All 'L' suffix tax codes got an uplift of 50 points (e.g. 1100L will change to 1150L) in accordance with the March 2016 Budget. This is to be effective from 6 April 2017 and will reflect on all screens showing an employee's tax code. Prefix of 'M' will get a 55-point increase and those with an 'N' a 45-point increase.

-

Tax Regime

In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

-

NB : A P45 or a Starter Check List must be received and entered into the Payroll system before the employee receives their first pay.

If the New starter is on a Pensioner payroll without a P45, then use the current emergency tax code (2017/18) which is 1150L with a Week1/ Month1 basis.

Additional information that needs to be provided to HMRC on the FPS in such cases are:

1. Occupational Pension Indicator - Please check this box.

2. Annual Amount of Occupational Pension - Please enter annual pension.

3. Occupational Pension paid because recently bereaved - This is where a spouse is taking the pension where the employee died. Please check this box if appropriate. In this case, all the details entered should relate to the spouse not the deceased.

4. Enter hours worked as 'E' Other - This will automatically be set once 'Occupational Pension' indicator is entered.

-

- Starter Checklist - Seconded to Work in the UK

This form must not be used for someone who is from Overseas who simply comes to work for you - refer to normal Starter Check List (No P45).

-

Employee Statement

Select the corresponding statement from the Starter Check List A, B or C here, as indicated by the seconded employee.

-

I have a Student Loan which is not fully repaid

If this is indicated on the Starter Check List, then please check this box.

-

Are you an EEA citizen?

These are: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Iceland, Liechtenstein, Norway, Switzerland.

-

Tax Code used

For Tax Year 2017-2018, operate tax code in relation to the "Employee Statement" as follows:

- Statement A - 1150L

- Statement B - 1150L Week 1/ Month 1

- Statement C - 1100L Week 1/ Month 1

Where also indicated as EEA citizen - 1100L even though Statement B & C shown NB. If the employee has not indicated any of the above, then the employer must enter "Employee Statement" as 'C' and operate tax at code 'T' on a Week1/ Month 1.

All 'L' suffix Tax codes got an uplift of 50 points (e.g. 1100L will change to 1150L) in accordance with the March 2016 Budget. This is to be effective from 6 April 2017 and will reflect on all screens showing an employee's tax code. Prefix of 'M' will get a 55-point increase and those with an 'N' a 45-point increase.

-

Tax Regime

In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

-

They're under an EPM6 (modified) PAYE scheme Expat employees

If you operate such a scheme by arrangement with HMRC, please indicate 'Yes' or 'No'.

-

- P6

P6 notifies the employer of a change in tax code for their employee. Sometimes this may also include details of previous pay & tax if they have recently started with you .

Where more than one P6 is received for an employee before the next payroll is run, please use the latest dated one.

Where the P6 contains previous pay & tax, please enter these. However, if you already hold previous pay & tax details for this employee from his/her supplied P45, then:

- If they are the same, ignore; or

- If they are different, overwrite the previous pay & tax figures with those as shown on the P6. This could mean that there may have been an error on the figures supplied on the P45.

- Tax Code

Enter the tax code including any prefix such as 'K' shown on the P45. Where this is prefixed with an 'S', then this must go in the tax regime.

-

Tax Regime

In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

-

Week1/ Month1

If shown, please check this box. This means that the tax has to be calculated on that basis without taking into account any previous pay & tax figures that maybe held.

- P9(T)

Do not operate P9(T) Coding changes until you are in a position to commence the new tax year.

The code changes notified are the result of a change in circumstances for those employees and will be disseminated to the employees individually by HMRC. They will not cater for the normal tax code uplift that occurs each year as a result of a review of the basic tax allowance attributable to 'L' suffix tax codes. These will be notified via a P9(X) notification which covers all the basic tax changes for the coming year and tells you what to do.

- Tax Code to Operate

Enter the tax code including any prefix such as 'K' shown on the P45. Where this is prefixed with an 'S', then this must go in the Tax Regime.

-

Tax Regime

In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

-

Week1/ Month1

If this is indicated on the coding notice, check this box. This signifies that the tax is not calculated on a cumulative basis.

Note: All 'L' suffix tax codes got an uplift of 50 points (e.g. 1100L will change to 1150L) in accordance with the March 2016 Budget. This is to be effective from 6 April 2017 and will reflect on all screens showing an employee's tax code. Prefix of 'M' will get a 55-point increase and those with an 'N' a 45-point increase.

- Tax Code to Operate

- Pension Starter No P45

-

Starter Statement

Select the corresponding statement from the Starter Check List A, B or C here, as indicated by the employee.

-

I have a Student Loan which is not fully repaid

If this is indicated on the Starter Check List, then please check this box.

- Current Tax Code

For Tax Year 2016-2017, once the appropriate employee statement has been entered, please use one of the following tax codes according to the statement entered:

- Statement A - Use 1150L

- Statement B - Use 1150L with a Week1/ Month 1 indicator

- Statement C - Use BR

If the employee has not indicated any of the above, then the employer must enter "Employee Statement" as 'C' and operate tax at code '0T' on a Week1/ Month 1.

-

Tax Regime

In order to identify individuals who will be subjected to the Scottish Rate Income Tax (SRIT), the HMRC will determine (via RTI inbound routines or via P45 for new starters) if a prefix of 'S' will be shown in an employee's tax code. This box will show the 'S' prefix where applicable on the FPS submission for an employee.

-

NB : A P45 or a Starter Check List must be received and entered into the Payroll system before the employee receives their first pay.

If the New starter is on a Pensioner payroll without a P45, then use the current emergency tax code (2017/18) which is 1150L with a Week1/ Month1 basis.

Additional information that needs to be provided to HMRC on the FPS in such cases are:

1. Occupational Pension Indicator - Please check this box.

2. Annual Amount of Occupational Pension - Please enter annual pension.

3. Occupational Pension paid because recently bereaved - This is where a spouse is taking the pension where the employee died. Please check this box if appropriate. In this case, all the details entered should relate to the spouse not the deceased.

4. Enter hours worked as 'E' Other - This will automatically be set once 'Occupational Pension' indicator is entered.

-

Identify the type of student loan.

| Code | Description |

|---|---|

| 1 | Type 1 |

| 2 | Type 2 |

| N | None |

Student Loan 'Type 1' has an earnings threshold of £17,775 while 'Type 2' has £21,000.

This is the period when

This is only entered when the SL is stopped by HMRC.

Once advised of the student loan end period, you can enter it here for the employee and deductions will cease.

Link

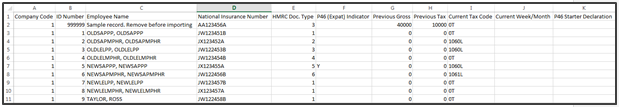

If you would rather import the data from a spreadsheet, you can download our template by selecting this link. If it is the first time you have added any data, then a dummy row will be displayed to help you. If you already have data, then that data will be downloaded to enable you to update it as well as add new data. You will need to remove the dummy data entered in the spreadsheet before import.

Although the file will open in Excel, it is important that it is saved as a CSV (Comma Separated Values) file. Otherwise, the import will not be completed.

All fields for all forms are available in the dropdown. Only populate the ones you require.

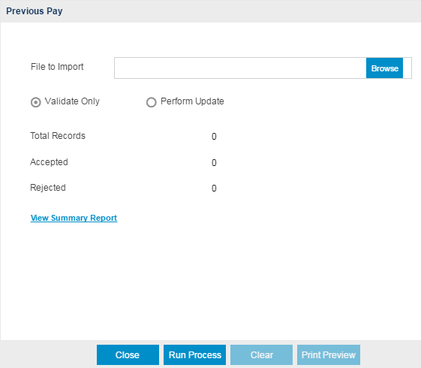

Upload will allow you to browse to the downloaded file and bring it in to the system.

You can either perform a validation or update the system once the file is located using the Browse option.

- Validate will advise you if you have any issue with the file before importing, enabling you to change the data. Select this option to test the format of the file and fields.

After running the Validate Only process, the system will produce a report detailing that the update is completed, and if there were errors encountered during the validation. The detailed information is shown in the Summary Report.

- Perform Update will upload the data and display it in the Previous Pay page of the Wizard for you to confirm by moving Next. Select this option to upload and update information in your database.

Select Next >> to continue with the workflow or select Back >> to return.

Click this link --> Setup Wizard if you want to go to the Wizard's Help.